Using Automatic Credit Requests

Learn when Automatic Credit Requests are filed and what you need to do.

Automatic Credit Requests (AKA System Credit Requests) automatically creates a credit request when specific conditions are met. In some cases, it may require you to submit additional evidence.

If your request is approved, we’ll return the full alert cost as a credit to your Balance.

Eligibility

You can request a credit for alerts with one of these statuses: Already a Chargeback, Failed Transaction, Previously Refunded, or Not Found.

See the Alert Status Reference Guide for details on each status.

To qualify, you must also meet these conditions:

- You have an active Chargeback.io account that received the alert.

- The alert is less than 14 days old.

- Your role is Owner, Admin, or Manager.

- You did not refund the customer directly through your payment processor.

- No other credit request exists for the same alert ID.

⚠️ Credits for 'Lost' alerts are only applicable if you could not find a transaction that matches the 'Lost' alert in your dashboard.

How Do I Know Whether an Credit is Manual or Automatic?

- In the sidebar, select Alerts.

- From the dropdown, select Credits.

- Click + Add Filter.

- Check the box beside Request Type.

- Once the filter is active, click Request Type again.

- From the dropdown, select System.

What The Proof Needed Status Appears?

Sometimes, we need extra documents to confirm if a credit is valid. If you see “Proof Needed,” follow these steps:

Step 1: Go to the Credits Page

- In the sidebar, select Alerts.

- From the dropdown, select Credits.

Step 2: Find the Credit(s) That Need Proof

- Click the Request Status filter.

- From the dropdown, check Requires Proof.

All credits that need proof will now be listed.

Step 3: Upload the Proof

Click the Framed Picture icon:

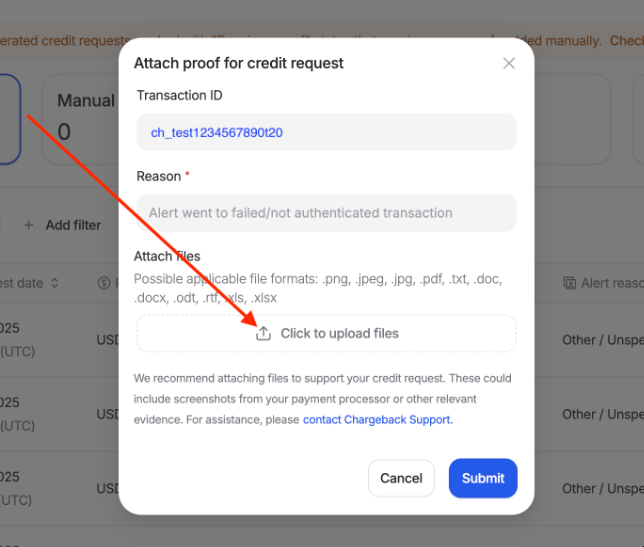

A pop-up window will appear. Click Click to Upload and choose your file(s):

How to Track Your Credit Status

You can track the progress of your credit request by:

- Select Alerts from the left sidebar.

- Choose Credits from the dropdown menu.

- Check the Request Status column for the current status.

- Clicking the eye icon on the right to view full submission details.

ℹ️ You will also receive automated emails from us when your credit is Approved or Rejected.

What To Do If Your Credit Request Is Rejected

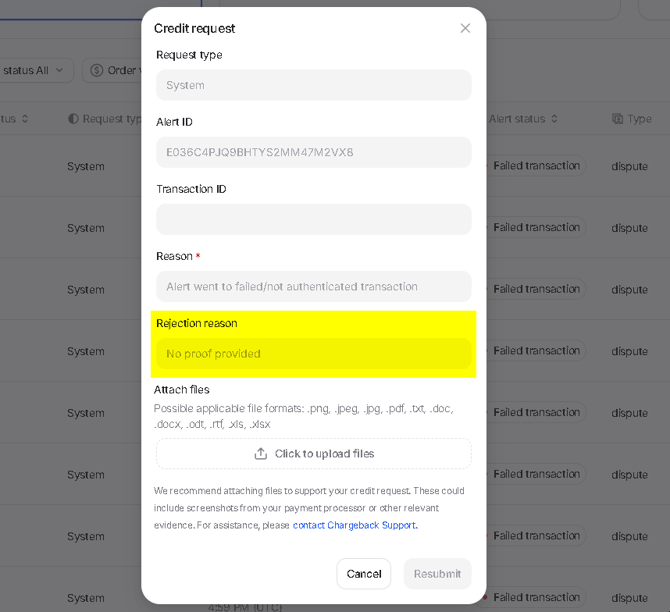

If you receive a rejection email or see a Rejected status in your dashboard, you can revise and resubmit the request with new evidence (up to 3 total submissions).

A request may be rejected for reasons such as:

- The selected reason was invalid.

- No evidence was attached.

- The attached files didn’t meet format or size requirements.

- The alert didn’t qualify for a credit.

- Other (explained in your rejection email).

Each rejection email includes the reason, so you’ll know what to correct before resubmitting. Review the notes, update your evidence, and submit the request again.

This screenshot is an example of what your dashboard will look like if a Credit is rejected.

What Evidence Do I Need?

Before submitting a Manual Credit Request, make sure your evidence meets the requirements below:

- Submit within 14 days of receiving the alert.

- Upload at least 1 file (maximum 20).

- Accepted formats:

.png,.jpeg,.jpg,.pdf,.txt,.doc,.docx,.odt,.rtf,.xls,.xlsx.

Every screenshot or document must clearly show your business name or merchant account ID.

For the statuses Already a Chargeback, Previously Refunded, Failed Transaction, and Declined, each screenshot must include at least three of the following details to identify the transaction:

- Card brand

- Last 4 digits of the card number

- Transaction amount

Here are more details on what to include for each status:

| Status | What Evidence Must Show |

| Already a Chargeback | Chargeback date and reference showing it occurred before the alert. |

| Previously Refunded | Refund date and confirmation showing it was processed before the alert. |

| Failed Transaction | Processor or bank record showing the payment failed or was not authenticated. |

| Declined | Processor or bank record showing the payment was declined. |

| Not Found | Screenshot of search results or transaction history showing no matching transaction for the alert. |

| Lost | Same rules as 'Not Found'. |

💡 Questions or concerns? Get help from our support specialists at Chargeback.io.