How Chargeback.io Works

Learn how Chargeback.io works, and what happens when you try to manage disputes without it.

In Short

Chargeback.io helps merchants prevent disputes from becoming chargebacks through real-time alerts and automated refunds.

Using Chargeback.io keeps your chargeback rate low, which helps you avoid:

- Account holds from payment processors

- MATCH List placement (the payment processor blacklist)

- Dispute monitoring programs such as Visa’s VAMP

- Chargeback fees and lost revenue

- Hours spent fighting disputes manually

- Higher processing fees due to processors raising rates when ratios increase

- Reputation loss from customers

- Closed payment processor account due to too many chargebacks

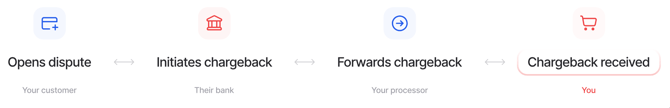

How a Chargeback Works

Here's how a typical chargeback proceeds without Chargeback.io:

- Customer disputes the payment: The shopper contacts their bank to question or reverse a transaction.

- Bank reviews the claim: The bank gives the shopper a temporary credit while investigating.

- You're notified late: Your processor receives the chargeback notice, usually days or weeks later.

- Funds and fees deducted: The disputed amount and chargeback fee are taken from the your account.

- You respond: You can submit evidence to fight the chargeback, but the process takes time and often fails.

- Reputation risk: Many chargebacks can label your business as high risk, leading to higher fees or account suspension.

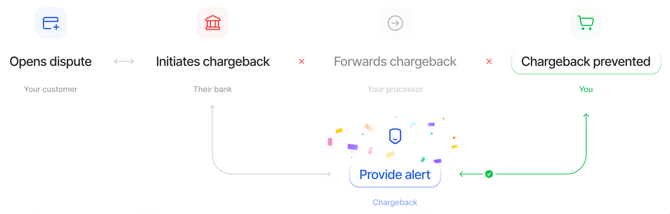

How Chargeback.io Works

Here's what happens when you're with Chargeback.io:

- Customer disputes a purchase: A shopper contacts their bank to challenge a payment.

- Chargeback.io receives a dispute alert: Through our partnerships with Ethoca, CDRN, and RDR, Chargeback.io gets a notice when a dispute is filed.

- You receive the alert: We send alerts directly to your email and display them in your Chargeback.io dashboard.

- Resolve the dispute:

- If RDR is enabled and the case has not yet become a chargeback, the transaction is automatically refunded.

- If you use CDRN or Ethoca and your payment processor connects to Chargeback.io, the refund also happens automatically.

- If automatic refunding is not available, you can manually refund or dispute the charge.

- You prevented a chargeback

A successful refund stops the chargeback process, saving money and protecting your standing with card networks like Visa.

Read this guide to learn the differences among RDR, CDRN, and Ethoca.

How Things Are With & Without Chargeback.io

| Without Chargeback.io | With Chargeback.io |

| You learn about disputes late | You get alerts instantly |

| Refunds too late to stop chargebacks | Refunds stop chargebacks early |

| You pay fees and lose time | You save money and prevent risk |

| Staff spend hours managing disputes | Alerts and refunds run automatically |

| Risk of account holds or termination | Stable payment processing |

| Possible placement on MATCH List | Protected from blacklist risk |

Without Chargeback.io, you react to losses. With it, you prevent them.

💡 Questions or concerns? Get help from our support specialists at Chargeback.io.