How to Locate Transactions with ‘Attention’ Chargeback Alerts

Learn how to identify and refund transactions linked to ‘Attention’ alerts that require manual action to prevent chargebacks.

Summary

Our integrations and apps with payment processors may not locate every transaction, so you may need to confirm whether a transaction exists.

The fastest way to search is by filtering the last 4 digits of the card number.

⚠️ If no transaction appears, change the alert status from Attention to Not Found and submit a Manual Credit Request using the instructions in this guide.

Contacting our support team about missing alerts will not speed up the process. They use the same Manual Credit Request form, so submitting it yourself is faster.

Manually Refund ‘Attention’ Alerts Immediately

If your Ethoca or CDRN alert status shows Attention, you have 24 – 70 hours to issue a refund through your payment processor platform. The time limit varies by the alert network.

If you do not refund within this window:

- The alert changes to Lost status.

- The transaction may become a chargeback within 120 days.

- We cannot refund the alert unless no transaction is linked.

You’ll receive an automated email when an alert enters Attention status. Ensure that this notification is turned on in your Notification Settings.

Follow this guide to confirm your notification settings.

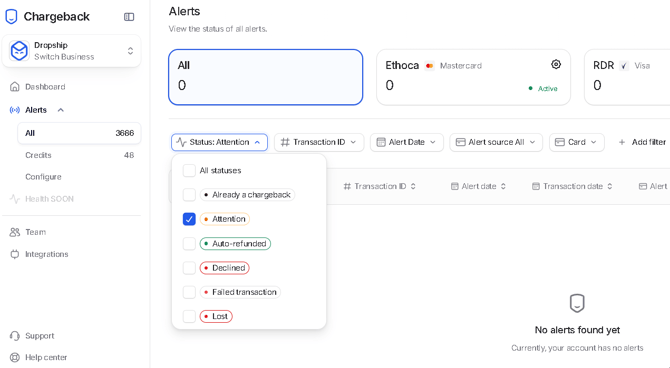

How to Find "Attention" Alerts

Find Attention-status alerts by clicking Alerts in your sidebar and filtering alerts by the status Attention.

Like this:

How to Locate Transactions in Your Payment Processor

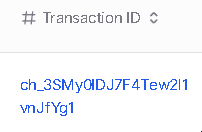

1. Transaction ID

The easiest way to find a chargeback alert is by clicking the link in the Transaction ID column. This link opens the connected transaction in your payment processor.

Not every alert includes a Transaction ID. Our system matches alerts as accurately as possible, but Ethoca and Verifi — the networks that send alerts — don’t always provide full transaction details.

⚠️ If multiple links appear, verify each one using the alert details (date, card number, amount) to confirm the correct match.

2. On Shopify

Use Shopify’s filters to locate transactions connected to alerts:

- Credit card: Last four digits of the card.

- Date: When the transaction occurred.

- Destination: Country where the transaction took place.

Chargeback.io displays all dates in UTC time. To locate a transaction, use Shopify’s Between date filter.

Example: If the alert shows March 10, 2025, search between March 9 and March 11.

To confirm timing differences, compare the customer’s local time zone with UTC using a time zone converter app.

⚠️ Alert timestamps may not exactly match processor timestamps, so searching by day gives the best results.

3. On Stripe

Use these filters in the Stripe search bar. Do not add spaces after colons:

- Last4: Last four digits of the card (e.g.,

Last4:1234). - Amount: Order value in USD (e.g.,

Amount:19for a $19 transaction). - Brand: Card brand (e.g., Visa, Mastercard).

- Date: Transaction date (use Between range).

- Country: Two-letter ISO code (e.g.,

USfor United States).

Use CTRL / CMD + F to search the ISO country code list faster.

All dates in Chargeback.io appear in UTC time. If an alert shows March 10, 2025, search between March 9 and March 11 in Stripe.

Compare the customer’s time zone with UTC using a converter app (e.g., World Time Buddy).

⚠️ Alert and processor timestamps rarely match exactly; searching by date range ensures accuracy.

4. Other Payment Processors

If you use another processor, apply filters based on alert data:

- Last 4 digits of the card

- BIN (first 6 digits)

- Date (may be approximate)

- Card network (Visa, Mastercard, etc.)

- Country of origin

- ARN (Acquirer Reference Number)

- Authorization code

All available alert data comes directly from Ethoca and Verifi. We cannot retrieve more details than what they provide.

What if a Customer Used Shop Pay, Apple Pay, or Google Pay?

Payments made through Shop Pay, Apple Pay, or Google Pay use tokenization, which hides card details and makes transaction searches more difficult.

Use every available filter to confirm the correct transaction and prevent chargebacks.

If you locate a possible match, verify it with the following indicators:

- Authorization code (most reliable)

- Issuer or bank

- Customer behavior

⚠️ Transaction data such as authorization codes and issuer details do not appear for Stripe Link payments unless Wallet Mode is enabled.

Contact Stripe Support to activate this feature.

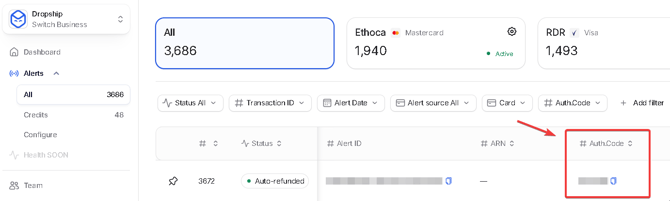

1. Authorization Code

Authorization codes appear only for transactions processed within the past 30 days.

This method works only when a value is shown under the Auth.Code column in your Chargeback.io dashboard.

Authorization codes contain 6 digits and are the most reliable way to confirm a transaction, even for tokenized payments.

The search process can take up to 3 minutes per transaction but ensures accuracy.

Compare the authorization code from your processor with the code listed in Chargeback.io.

If they match, the transaction is confirmed. If not, continue searching.

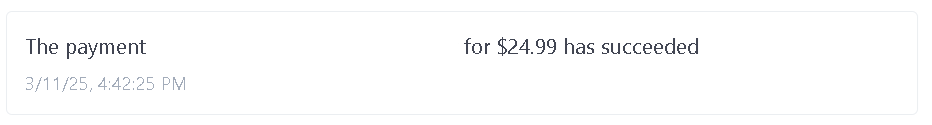

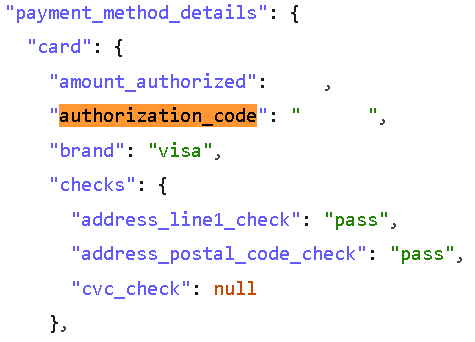

1A. Authorization Codes in Stripe

- Open the transaction and scroll to the Events and Logs section.

- In the All Activity column, locate the event labeled “The payment X for $X has succeeded.”

- In the From Stripe column, click “See all X lines.”

- Search the expanded lines for the field

"authorization_code": XXXXXX.

To speed up the process, press CTRL / CMD + F and search for “authorization_code.”

Image for Step 2:

Image for Step 4:

1B. Authorization Codes in Shopify

- Open the transaction timeline and locate the payment entry.

- Example: A $1.99 USD payment was processed using a Mastercard ending in XXXX via Apple Pay.

- Expand the dropdown and scroll to Information from the gateway.

- Under Payment Method Details, find

“authorization_code” => “XXXXXX”. - Compare this six-digit code to the Auth.Code in your Chargeback.io dashboard.

2. Issuer

Check the Issuer listed in Stripe or Shopify and compare it to the Bank shown in Chargeback.io.

This method does not guarantee a match but helps narrow possible results.

3. Suspicious Customers

Review the customer’s account for a pattern of refunds, high dispute frequency, or other suspicious activity.

If the behavior aligns with alert details, you may have identified the transaction.

Use this only as a supplementary method to avoid chargebacks.

Why Wasn't a Transaction Auto-Refunded?

Our integrations cannot always identify every transaction. Tokenized payment methods such as Apple Pay, Google Pay, or Shop Pay can hide card details, preventing automatic matching and refunds.

When this happens, manually check your payment processor to confirm whether the transaction exists before taking further action.

💡 Questions or concerns? Get help from our support specialists at Chargeback.io.