What is Balance Billing?

Learn what the new Balance feature is for Chargeback.io and how it works.

In short:

Balance replaces invoice-based billing with a prepaid Balance. You add funds up front, and we deduct alert costs from that Balance as they occur. This setup removes complex billing cycles and lowers the chance of payment failures or unintended deactivations.

What is Balance?

Balance (Balance Billing or Balance Top-Up) lets you add funds to your Chargeback.io account. When an alert posts a charge, we deduct the amount from your Balance immediately instead of invoicing at the end of a billing period.

This approach reduces failed payments due to outdated card details and avoids accidental account deactivation.

1. Changes to Account Creation

Starting September 15, 2025, new users must add a minimum $100 during signup.

This minimum ensures you can cover chargeback alerts from day one and avoid billing issues.

2. For Currently Enrolled Users

You get a 30-day grace period to add funds and switch to Balance.

If a Balance is not added after 30 days, currently enrolled accounts will be unenrolled, meaning that we won't be able to prevent chargebacks for your account.

The steps below show you how to add funds to your Balance.

Are Balances Refundable?

Balances (top-ups) are refundable up to $10,000 after all descriptors are fully unenrolled from all alerts networks (e.g., Ethoca) under all of your accounts.

Once all of your accounts are fully unenrolled, contact our support and let them know you'd like a refund. From there, we'll refund you.

How to Add a Balance

1. Open Account Settings in the lower-left corner, then select Settings.

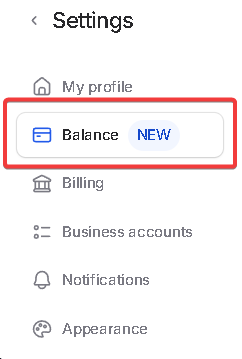

2. In the left sidebar, choose Balance.

3. Click Add Funds. Enter an amount or pick a preset. The modal shows:

3. Click Add Funds. Enter an amount or pick a preset. The modal shows:- Current: your current Balance

- Minimum: the minimum you must add

- Recommended: a suggested amount based on recent alert volume

4. Click Continue to confirm and fund your Balance.

Low Balance & Deactivation (Important)

If your Balance falls to 30% of your Minimum, your account enters a deactivation risk state. We may deactivate the account after 10 days if you do not fund it.

To avoid interruptions, set up Automatic Top-Ups and keep a valid, non-expired card on file.

Failed top-ups due to an expired card may lead to deactivation.

How to Set Automatic Top-Ups (Optional)

Automatic Top-Ups refill your Balance when it drops below a threshold you choose.

Edit this through the following values:

- When My Balance Goes Below: the trigger amount for the top-up. You cannot set this below your Minimum.

- Example: if your Balance drops below $500, the top-up triggers.

- Fill My Balance Up With: the amount we add when the trigger fires.

- Example: when the trigger amount hits $500, we add $2,000.

⚠️ Ensure the card saved to your account has not expired. Failed billing attempts for Automatic Top-Ups may result in deactivation.

⚠️ Auto Top-Up does not work with Shopify Payments due to Shopify's policies. If you pay for Balances with Shopify, you must manually top-up your Balance or you will receive invoices to be paid manually.

How Balance Affects Manual & Automatic Credit Requests

- Manual Credit: when we approve a Manual Credit, we add funds to your Balance instantly. You can submit one Manual Credit request per Alert ID.

- Automatic Credit Request: when we approve it, we mark the alert paid and leave your Balance unchanged. If we deny it, we withdraw the alert cost from your Balance.

General Information About Balances (Useful)

- You can deposit any amount; we don’t set an upper limit.

- We send notifications by email for events like low Balance and successful top-ups.

- Balances exist at the user level. Your Balance displays the same across all business accounts you access.

- At this time, only the Owner role can view Balance. Admins, Viewers, Managers, and other roles cannot view Balance.

- You can't disable auto top-up. If you have issues regarding automatic top-ups, let out support specialists know.

💡 Questions or concerns? Get help from our support specialists at Chargeback.